COVID-19 - The increased risks for the Corporate Criminal Offence

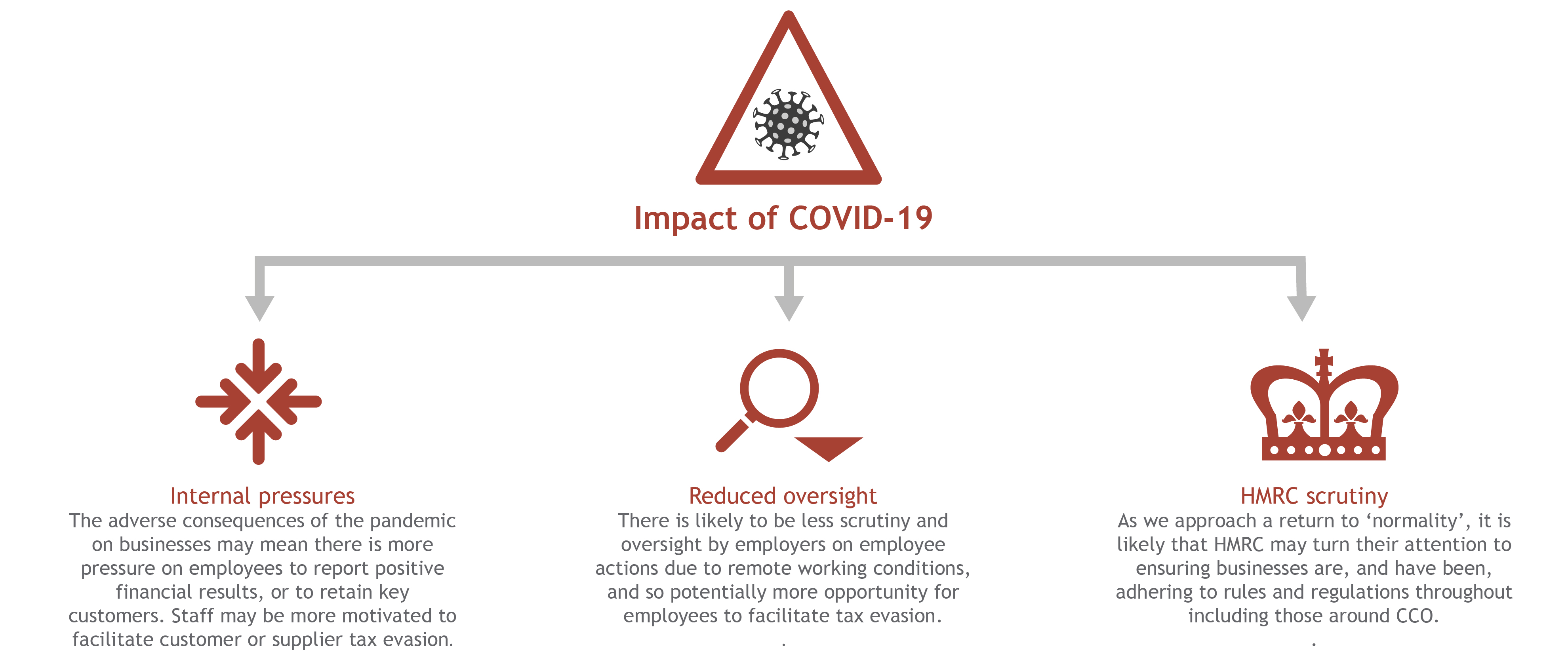

The pandemic has distracted some businesses from their compliance obligations, at a time when risks of fraud and tax evasion are elevated – CCO should be considered now more than ever.

The pandemic has distracted some businesses from their compliance obligations, at a time when risks of fraud and tax evasion are elevated. CCO should be considered now more than ever.

The Corporate Criminal Offence (“CCO”) applies to all corporate entities irrespective of size, together with partnerships and charities, that fail to prevent the facilitation of UK or foreign tax evasion by associated persons. Tax evasion in this context means any offence of cheating the public revenue, and therefore could include fraudulent claims under the Covid-19 Job Retention Scheme or other government support packages.

The Covid-19 pandemic has meant compliance obligations such as CCO have taken a back seat, leaving businesses at risk of significant fines and penalties and reputational damage. HMRC are continuing to take CCO compliance very seriously and is actively enforcing the legislation.

What do businesses need to consider?

1. Associated persons

It is vital to consider all associated persons in your business and re-evaluate the level of risk posed by each group in light of Covid-19. An associated person is an individual or an entity performing services for or on behalf of the business when the tax evasion facilitation offence takes place. This can include employees, agents and contractors, amongst others. Businesses should ensure existing policies and procedures are reviewed and amended as necessary to reflect the impact of any elevated risks under Covid-19.

2. New working arrangements

Consideration should be given to how effective your existing prevention procedures are with a remote workforce. Are there any elements of the procedure that cannot be done remotely? For example, onboarding checks and controls may be harder to execute, and it may be more difficult to monitor staff compliance with business policies.

3. Use of Government schemes

The Government measures supporting business and employees have been pivotal to many businesses throughout these unprecedented times. The high-profile nature of the Covid-19 support schemes is likely to attract scrutiny from HMRC; we are already seeing HMRC investigations into fraudulent claims made under the Job Retention Scheme.

4. Reputation

The impact of Covid-19 is likely to put more pressure on businesses to demonstrate they have the right controls in place and are doing the right thing.

How S&W can help

It is important that businesses ensure reasonable prevention procedures are in place as this acts as the business’ only defence in case of prosecution. These should be designed to prevent associated persons from committing the facilitation offences and should be proportionate to the risks identified.

-

Risk assessment

We have supported businesses of all sizes and across a range of sectors with their risk assessment process. We can provide context to what is likely to be considered ‘reasonable’, by benchmarking your procedures against those of other similar businesses.

A risk assessment can be performed remotely and usually involves a workshop with key individuals from the business.

-

Training

We have developed a bespoke e-learning course that has been designed to address the training requirement set out by HMRC. The e-learning module can be easily uploaded to your existing Learning Management System for roll-out to staff, or we can provide a platform through which you can distribute the training. This method of e-training is well suited to remote working.

-

Ongoing monitoring and review

Risk assessments should be regularly reviewed, particularly for the impact of Covid-19 where working practices and potentially business activities have changed, for example, if you have been forced to change suppliers or if you have pivoted your business model and are now operating in a new market.

For businesses who have already performed a risk assessment, we can support with carrying out CCO health-checks, which normally involves reviewing your existing policies and procedures as well as refreshing your current risk assessment to reflect any changes in the business.

Ref: NTNPW072088

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.