How equity based remuneration plans benefit early stage businesses

Growing a successful business means recruiting the right talent. Retaining them requires an attractive benefits package. Equity based remuneration plans have many benefits for early stage businesses.

Growing a successful business means recruiting the right talent. Retaining them requires an attractive benefits package. Equity based remuneration plans have many benefits for early stage businesses.

As a business owner, ensuring that your employees’ interests are aligned with your own can be significant in maximising shareholder value. Allocating a share of the equity to key staff is often used to achieve this alignment, particularly where fast growing entrepreneurial companies may not have the capacity to match salaries paid elsewhere.

The most flexible and tax efficient method of enabling employees to share in the equity growth is to use the Enterprise Management Incentive (EMI).

What is the Enterprise Management Incentive?

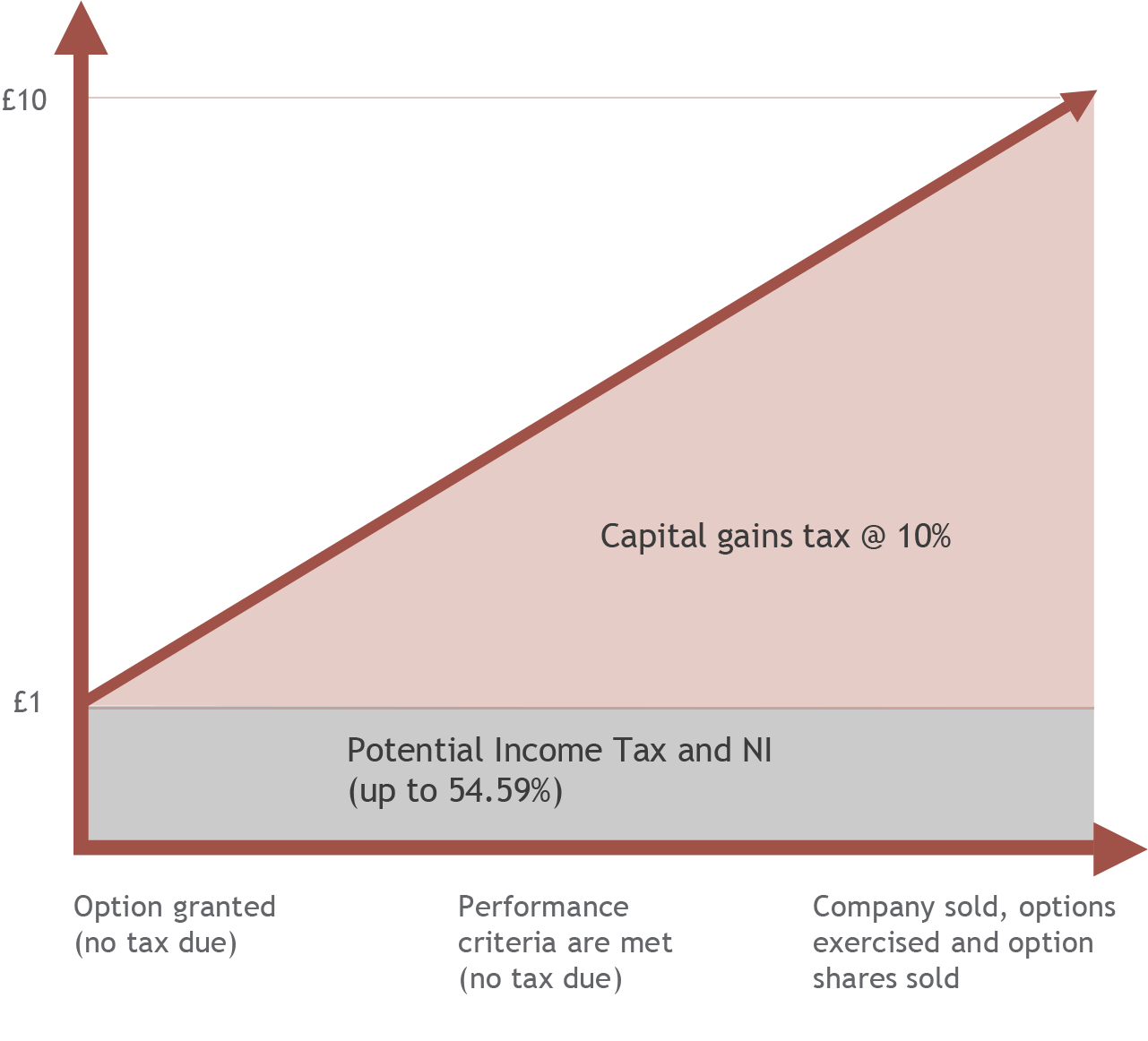

The EMI is a flexible, discretionary, tax advantaged share option scheme that can enable full time employees to benefit from a 10% tax rate on future share sale, without incurring any tax liabilities until the value is realised.

An employee only acquires the shares when they exercise the option, even though they can benefit from share price growth from the date of grant. When the employee exercises the option, they pay an amount to acquire the option shares. This exercise price is often set at the market value of the shares at the date of grant (although the exercise price is at the discretion of the company).

As the EMI is such a valuable relief, it is only available to SMEs with gross assets of less than £30m. It is also not available to companies that carry on specific excluded activities, perceived to be “lower risk”.

What are the tax implications of using the EMI?

The grant of an EMI option generally has no tax consequences for the company or the employee.

On exercise, income tax at a top rate of 45% (and potentially NIC) will be due, but only based on the excess of the value of the shares at the date of grant over the exercise price. Provided that the exercise price is set at the market value of the shares on grant, no tax should be due by the company or the employee.

When the employee sells their option shares, capital gains tax will be payable on the sale proceeds less the exercise price, less any amount subject to income tax on exercise.

The CGT rate on EMI gains is usually 10%, compared to a general top rate of 20%. This is by virtue of claiming entrepreneurs’ relief. Ordinarily, an individual holding less than 5% of ordinary share capital would not qualify for entrepreneurs’ relief. However, shares acquired via an EMI option can qualify for the reduced rate regardless of percentage owned, provided they are sold at least 12 months after the option is granted.

The company can claim a corporation tax deduction on the “option gain” on exercise. This is a very valuable relief and its tax value to the company should be captured, as far as possible, by the exiting shareholders as part of any share sale negotiation.

These tax principals are illustrated below:

Flexibility

An EMI plan allows the company flexibility to set performance conditions to be met for the option to vest, specific to each option holder. E.g. the option may only become exercisable on a sale of the company and on the company, individual, or their team having hit certain targets.

Comparing EMI options to share awards

If an employee purchases shares at a discount to the market value, they will be subject to income tax (and potentially NIC) on the discount, which can result in a tax liability for employees who do not necessarily have the cash funds to meet this.

An EMI plan is also easier to administer than direct share awards as employees do not hold shares until they exercise their option. E.g. if the option is ‘exit only’ (i.e. exercisable only on the sale of the company or its trade), the employee will only hold their shares for a short period before selling their shares along with the other shareholders.

Employees not owning shares from the outset also means that dividends and voting rights only apply to existing shareholders. This can be helpful in a sale process, keeping the shareholder group streamlined, often easing negotiations with prospective buyers.

Where an employee leaves the company before exercising their options, this typically results in their option lapsing which is administratively simpler than share forfeiture.

There are also various aspects of the implementation process which can be approved by HMRC in advance, which helps add tax certainty. An EMI plan offers both practical administration and tax benefits to growth businesses and employees compared with direct share acquisition.

Where employees have been earmarked for equity, the company should consider implementing an EMI plan sooner rather than later as the tax benefits and commercial incentives for employees are greatest when the share value is still low.

As EMI offers such a valuable relief, legislation does restrict its availability and application. If EMI options can be used, the terms of the option need to be set appropriately to achieve the right balance of incentivisation. They also need to be communicated clearly to employees, so that the business and the existing shareholders gain full value from sharing in future growth with option holders.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.