New model real estate

Commercial property investment has long had a familiar structure: capital outlay to buy a building, income generated by a tenant, with the owner responsibility for day to day management. The vulnerabilities of this model have been exposed, notably by the weakness in the retail sector, where the struggles of individual tenants have given property companies considerable headaches.

Commercial property investment has long had a familiar structure. There is a large capital outlay to buy a building; income is generated by a, hopefully, reliable tenant; while the owner agrees to paint the walls or replace the air conditioning every so often.

However, this is starting to change. We are seeing more firms shifting their businesses to an operating model leaving them more akin to service-based companies. This has implications not just for the managers but also for real estate investors.

Under the existing model, valuations are based on the expected income of the building and the prevailing market yields with some adjustment for factors such as tenant quality. This model has its vulnerabilities. These have been writ large in the retail sector, where the weakness of individual tenants has given some property companies considerable headaches. They have found themselves embroiled in Company Voluntary Arrangements (CVAs), for example, which have hit both rental income and the yields being applied to that income.

Equally, in an environment of lower interest rates, returns have thinned out as yields have compressed. The cost of high-quality buildings in good locations, let on long-leases to solid tenants, is climbing ever higher. Even in value-add situations, investors are pricing in perfection on asset management opportunities. The effect is that the winner of a property auction is increasingly the investor with the lowest cost of capital. The exception being when the vendor’s desire is for certainty, in which case, the investor with the better reputation for execution will prevail.

Property companies have been looking for a better solution and we see an increasing number embracing an operating model. In this approach, companies create value through the service they provide. Tenants are thought of as customers and the property company seeks to provide amenities that will continue to meet their clients’ changing needs.

The value for the property companies is based on the strength of their platform. A well-established platform enables them to buy an asset, stamp it with their branding, equip it in line with their other properties and manage it using existing resources. These companies can drive performance through their brands, their websites, their lettings platform, and the ability to use their scale to drive cost-efficiencies.

In being able to derive more income than a non-platform business, firms with a higher cost of capital can better compete for assets. It means the value of each asset is worth more plugged into the platform than it would be as an isolated property, thus those firms can pay higher prices. In addition, by developing the platform, firms can build a reputation for effective execution of transactions.

This isn’t, in fact, a new model. The serviced office industry began in the US in 1962 with the founding of the OmniOffices Group (bought by Regus in 2004). The storage industry began in the UK in the 1980s, but it wasn’t until 1998 that both Big Yellow Storage and Safestore were launched, understanding that a recognisable name, with appropriately located property (in this case, near a major road in an urban centre) could be a winning business idea.

The residential sector followed with student property leading the way. Companies such as Unite have built reputations as providers of well-managed, well-serviced buildings, making them popular with the student body they serve. The idea of brand value is becoming more broadly accepted in a way it hasn’t been before. Unite fills its rooms based on the reputation of the service it provides and tends to be over-subscribed.

A similar phenomenon is being seen across the real estate industry. New sectors are emerging as public tastes change - cohousing with hotel-like amenities, for example. The nascent private rental sector services a new generation of urban professionals used to the amenities on offer in their student residence but who cannot afford to buy in the heart of a city and are disinclined to commute. New accommodation options have proliferated, with gyms, Wi-Fi, freshly-brewed coffee, and of course the most important: doggy day care.

Companies shifting to this operating model are becoming an increasingly important part of the overall commercial property sector. Their growth shows the potential value inherent within the letting platforms that these companies develop. At the same time, a strong platform can be a major competitive barrier to entry. Many have been able to drive income sustainably higher as a result.

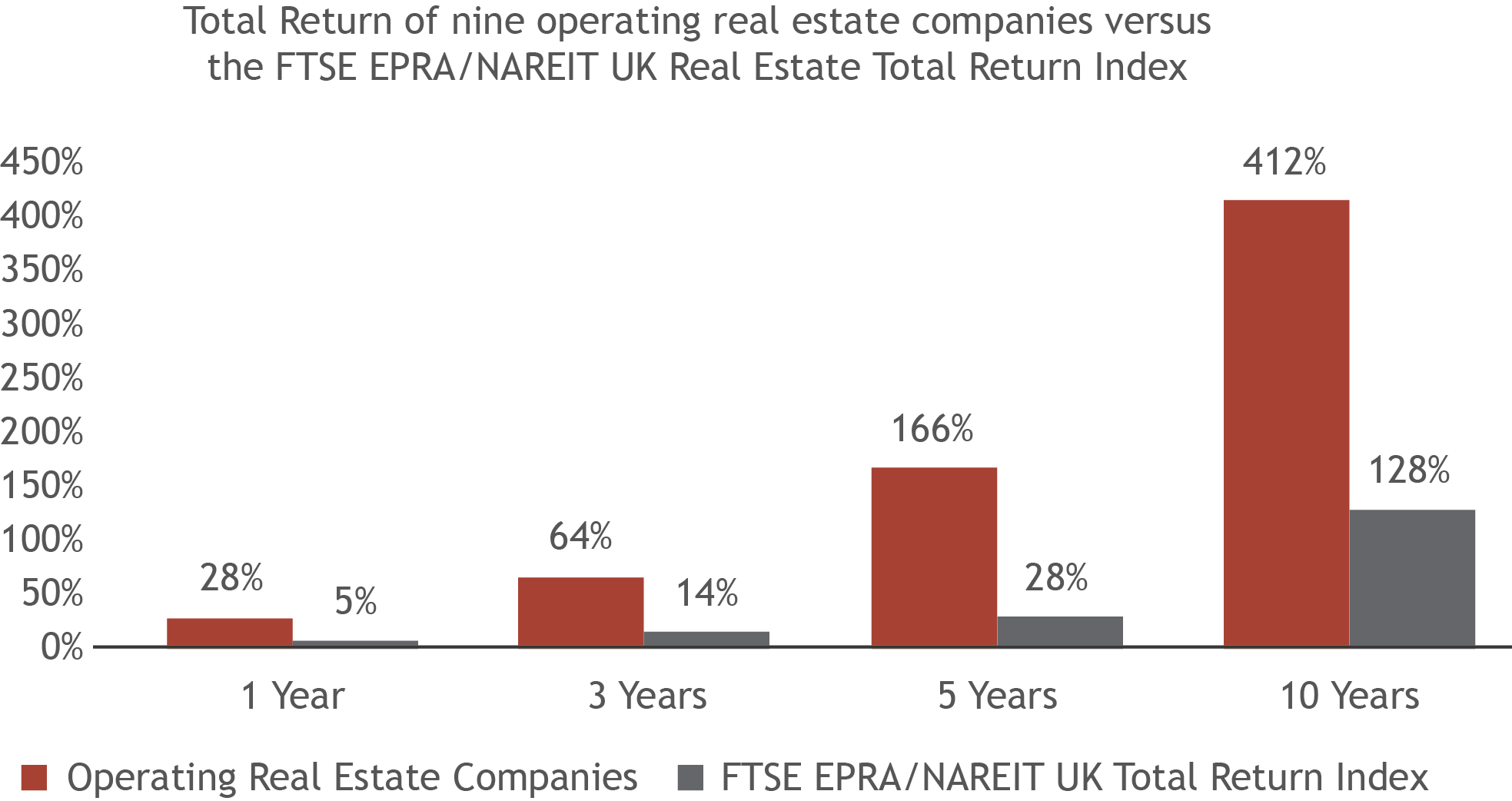

Recent research from Peel Hunt showed that listed companies with this business model have materially outperformed the wider property index over all timeframes. While these companies may have had some natural advantages (such as not being exposed to the retail sector), we believe the platform is key to this strength:

Source: Peel Hunt, Smith & Williamson

The data in the chart is to 30th September 2019.

The underlying companies are: Sirius Real Estate, Workspace, IWG, Unite Group, GCP Student Living, Big Yellow Group, Safestore, Lok’n Store, and Grainger.

Indeed, investors will need to change the way they think too. Rather than rely on Net Asset Value (NAV) and yield, we will need to think about earnings and cost management. Companies will need to understand the client journey and develop a consumer-focused way of doing business. They also need forensic cost control – and some companies have struggled. We saw one student property firm almost come unstuck when it misjudged the costs of building its platform, thankfully saved by a new, more cost-conscious chief financial officer.

There are also risks in a weaker economic environment. Part of the reason some of these models work so well is all the ancillary options – CCTV, security, gardening. Will people pay for that in more difficult times?

That said, we believe real estate businesses with a highly efficient platform have an advantage. It may not be the right option for every company, but, for many property firms, it brings a new dimension with which to drive tenant demand and enhance returns.

Dermot Mahony

Associate Director

Smith & Williamson Investment Management LLP

T: +44 (0) 20 7131 4462

E: dermot.mahony@smithandwilliamson.com

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.