The continued dominance of legal technology

The continued dominance of legal technology - Investments in technology continue to dominate law firm budgets and their strategic direction

The continued dominance of legal technology - Investments in technology continue to dominate law firm budgets and their strategic direction

As in previous years, technology continues to be a highly important strategic pillar of all law firms as they continue to react to client demand, new competitive forces and the ongoing challenge of an increasingly digital workplace.

Technology continues to absorb a large chunk of legal firms’ budgets and also to impact their strategic direction. The aim of technology investment is, in aggregate, improved efficiency and client integration through greater transparency and collaboration, but that does not do justice to the complexity of the solutions adopted by law firms.

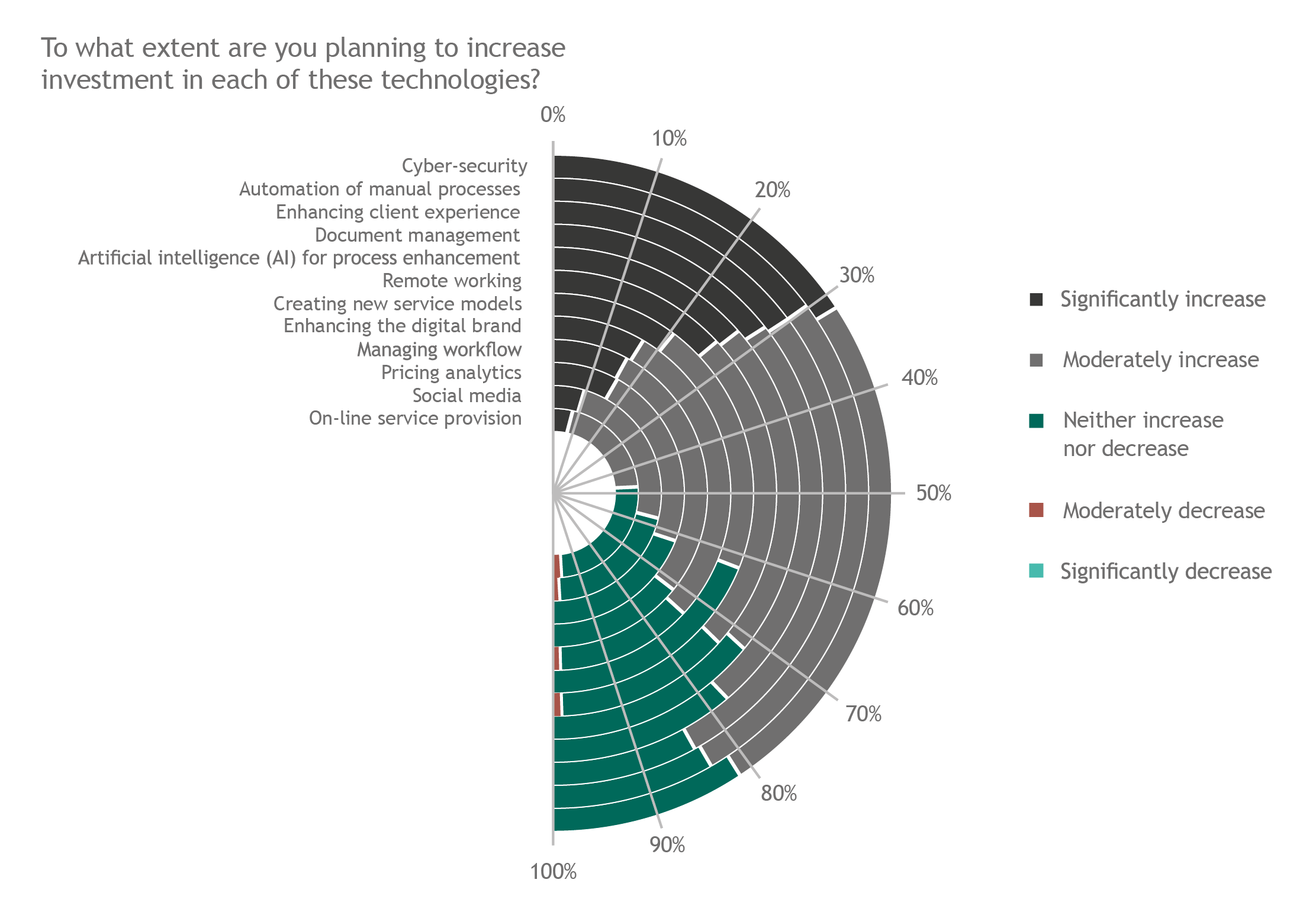

Cyber-security remains the key priority for legal firms, however. This year 31% of respondents to the Smith & Williamson Law firm survey indicated they will significantly increase investment in this area to enable their firms to stay on top of security and deliver robust systems to keep client data secure.

Running a very close second, with 30% planning to invest significantly, is the automation of manual processes and enhancing the client experience (last year’s top investment area). These results indicate that firms continue their pursuit of improved efficiency with the client sitting at the heart of what they are doing.

Priorities over the next 12 months, however, are a little different. At the top, with 78% of respondents ranking it in their top four investments, is pricing analysis, which is continuing to heat up as a key area of strategic focus. By analysing the data in a practice management system firms can identify matters of a similar nature and interrogate historical billing information to identify future pricing models.

Improved pricing analysis comes out of implementing AI solutions across large data sets which in turn deliver efficiency gains through improved resource management, and greater billing transparency to clients – multiple technologies coming together to deliver broad benefits to both the firm and its clients.

However, pricing analysis is just one piece of a more complex puzzle, which incorporates efforts to enhance the client experience with collaboration and communication tools to create a transparent client engagement experience. As one partner put it: “We focus on transparency and immediacy so the accounts should never come as a surprise to the client… the feedback loop we have on our billing system is so tight that we can make adjustments almost on an intra-day basis.”

This shows that investments in technology cannot necessarily be compartmentalised as the lines are blurred or the solutions that are produced cut across many different aspects of the legal delivery process. Although in the example used here one would hope that improvements to pricing and availability for clients to see billing data would mean a positive impact on lock-up.

It also shows that AI’s value lies in integrating it with other solutions. Much has been written about AI. Initially it was heralded as the next great revolution, but then there were questions about how much of this was simply hype. In our view, AI cannot be taken in isolation. It is a composite part of a broader solution and is beginning to deliver results for the firms that have invested and persisted.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.