Auto-enrolment increases – are you ‘phased’?

Why you should build rate increase into your budget now and communicate the financial impact to your employees

The minimum contributions that employers and employees pay into automatic enrolment schemes will increase in April 2018.

If you have not fully considered the financial implications of the increase in auto-enrolment contributions for your employees, you should build this cost into your budget now.

It would also be wise to communicate the financial impact of the imminent contribution rate increase to your employees, before they see the change on their payslip.

What is changing?

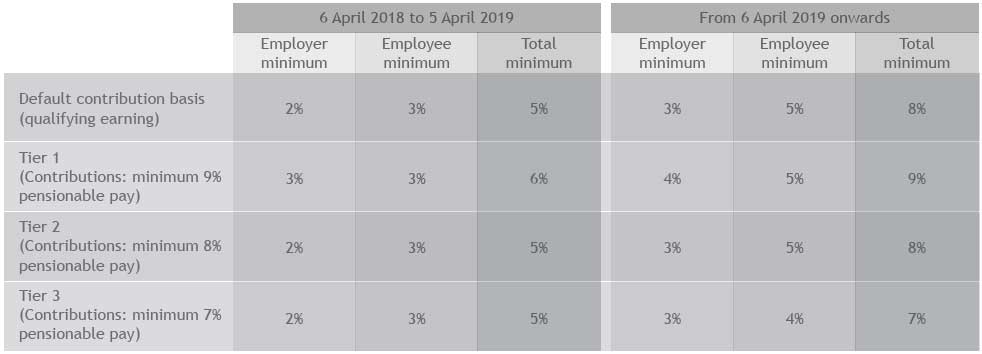

The future minimum contribution levels from April 2018 on a qualifying earnings and total pay can be seen in the table below.

Communicating with employees

While there are no legislative duties under auto-enrolment compelling employers to notify employees of the contribution increases, we would recommend that all companies pro-actively communicate with their workforce, not least because it will help to reduce employee queries.

One area where HR and Payroll departments will need to take particular care is with ‘contractual enrolment’ where employees have joined a pension scheme as part of their conditions of employment (which would clearly set out in the employment contract that pension contributions will be deducted from salary).

If the authority to deduct pension contributions did not make reference to the phasing of minimum contributions in 2018 and beyond, additional specific employee consent to the increased deduction may be required.

How you can mitigate against costs

Many employers already use salary sacrifice under their auto-enrolment schemes.

As a reminder, salary sacrifice allows an employee to exchange a portion of their gross salary in exchange for a non-cash benefit i.e. a pension contribution. This culminates in a saving of tax and National Insurance, which can then assist in funding the pension. This is perhaps more relevant in a minimum contribution environment.

For the employer, a saving in corporate National Insurance contributions (NICs) can also be achieved, although the arrangement can be ‘cost neutral’ for the employer if they decide to share their savings with employees.

In an environment of minimal pay increases, many employers are now introducing salary sacrifice and sharing the 13.8% NICs with the employee so as to assist in meeting the additional costs of auto-enrolment arising in 2018 and beyond.

If you need assistance in communicating the contribution increase to your employees or wish to consider implementing a salary sacrifice arrangement, then please contact Julia Ridger.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.