Business-to-consumer transactions: the new UK VAT rules for e-commerce

Advancements in technology have dramatically affected how businesses connect with consumers. E-commerce now provides vendors, both large and small, with an opportunity to showcase low value and expensive merchandise to a global audience. Indeed, it is well publicised that some retailers have closed their physical stores altogether and are engaging with customers exclusively on an online basis.

Advancements in technology have dramatically affected how businesses connect with consumers. E-commerce now provides vendors, both large and small, with an opportunity to showcase low value and expensive merchandise to a global audience. Indeed, it is well publicised that some retailers have closed their physical stores altogether and are engaging with customers exclusively on an online basis.

The changes

Changes to the tax landscape post-Brexit have prompted HMRC to amend UK VAT legislation to incorporate this B2C supply chain revolution, with the aim of establishing a more level VAT footing between UK and non-UK e-commerce businesses.

HMRC, similarly to more recent EU initiatives, has introduced two changes to ensure UK VAT is applied consistently:

1. Direct B2C sales consignments of £135 or less

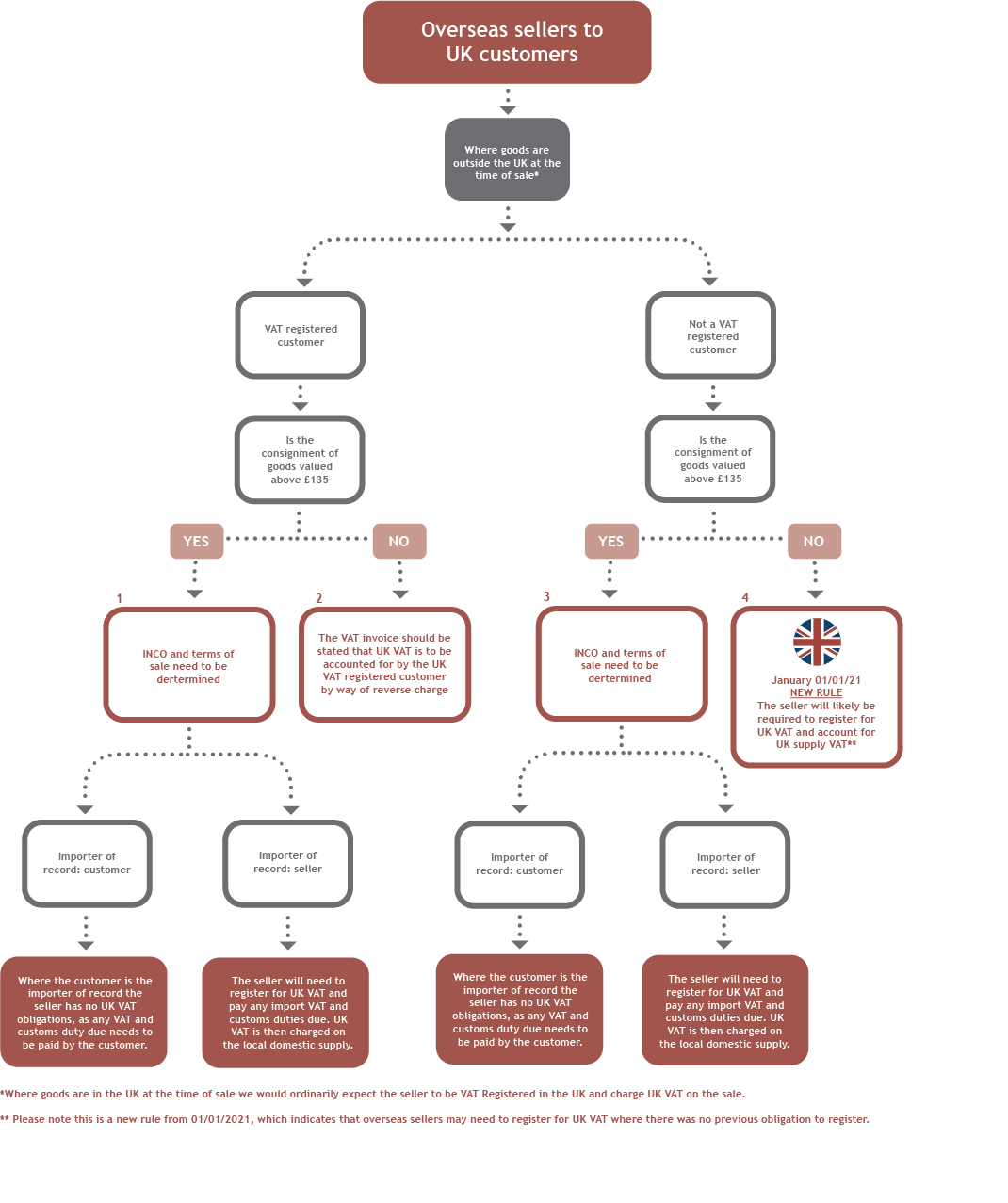

Non-UK sellers are now required to charge UK VAT on their sales to UK consumers if the value of the goods is £135 or less. There is no minimum VAT registration threshold for non-UK established sellers. The flowchart below depicts the position in more detail, explaining the B2B position and expanding on the considerations when the value of goods sold exceeds £135.

2. Deemed supplier and Online Market Place (OMP) rules

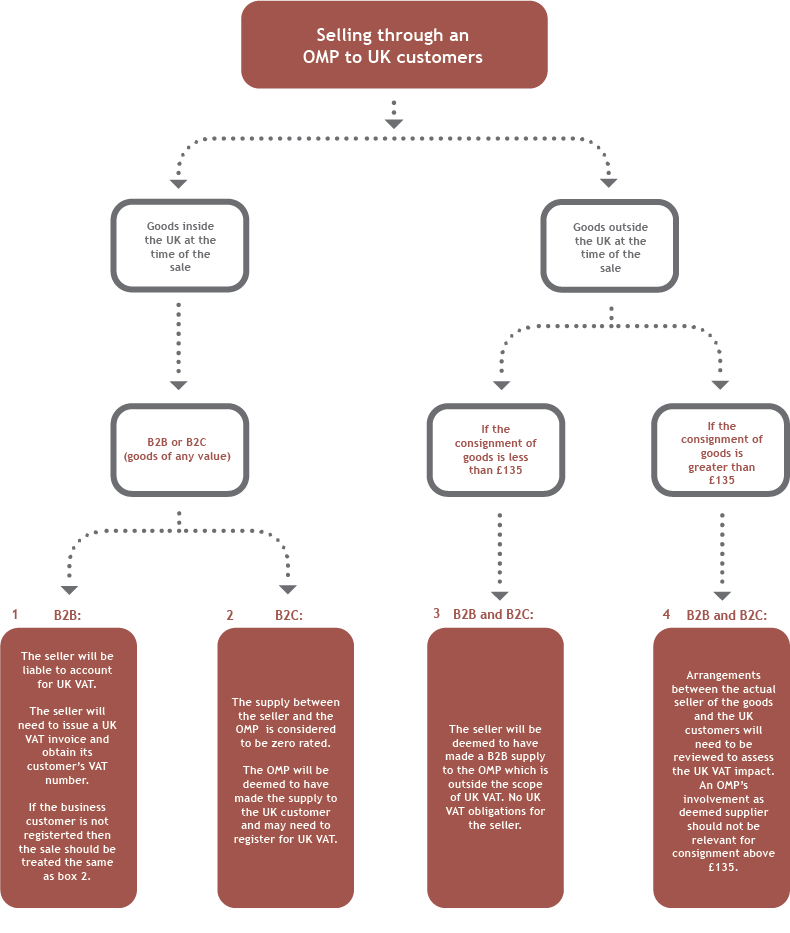

The second strand of HMRC’s plan to protect the UK’s VAT revenue is its focus on digital platforms that bring sellers and buyers together in a virtual marketplace setting to facilitate sales. Rather than relying on the overseas sellers to comply with their UK VAT obligations, the UK has shifted the burden for some sales to the marketplaces themselves. The flowchart below explains how the liability for UK VAT is shifted from the seller to the OMP, as well as the B2B considerations and the differences between when goods are delivered from an overseas location in comparison to those already stocked in the UK.

Practical implications for businesses

There has been a degree of uncertainty since the new rules were introduced, but now, six months later, it is clearer how the practical implications of the rules should be managed.

All non-UK businesses that are involved with supplies of goods to UK consumers should review their supply chains to determine whether or not they comply with the new rules correctly. A UK VAT registration may be necessary where there was previously no requirement to register. Where EU businesses were already VAT registered in the UK prior to 31 December, for example as a result of breaching the distance selling thresholds, businesses may continue to use their current UK VAT registration to satisfy UK VAT requirements from 1 January 2021.

Furthermore, overseas sellers that sell low-value goods exclusively through an OMP may have an opportunity to reduce their UK VAT compliance burden.

Please contact one of our VAT advisors to discuss your business’s particular circumstances.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Tax legislation is that prevailing at the time, is subject to change without notice and depends on individual circumstances. Clients should always seek appropriate tax advice before making decisions. HMRC Tax Year 2022/23.

Smith & Williamson LLP

Regulated by the Institute of Chartered Accountants in England and Wales for a range of investment business activities.

Smith & Williamson LLP is a member of Nexia International, a leading, global network of independent accounting and consulting firms. Please see https://nexia.com/member-firm-disclaimer/ for further details.

Smith & Williamson LLP is part of the Tilney Smith & Williamson group.

Registered in England No. OC 369631.

Ref: NTGH6092187

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.