Corporate Criminal Offence – facilitation of tax evasion

Overview of the CCO rules brought in by Criminal Finances Act 2017 and how we can help clients to mitigate their risk

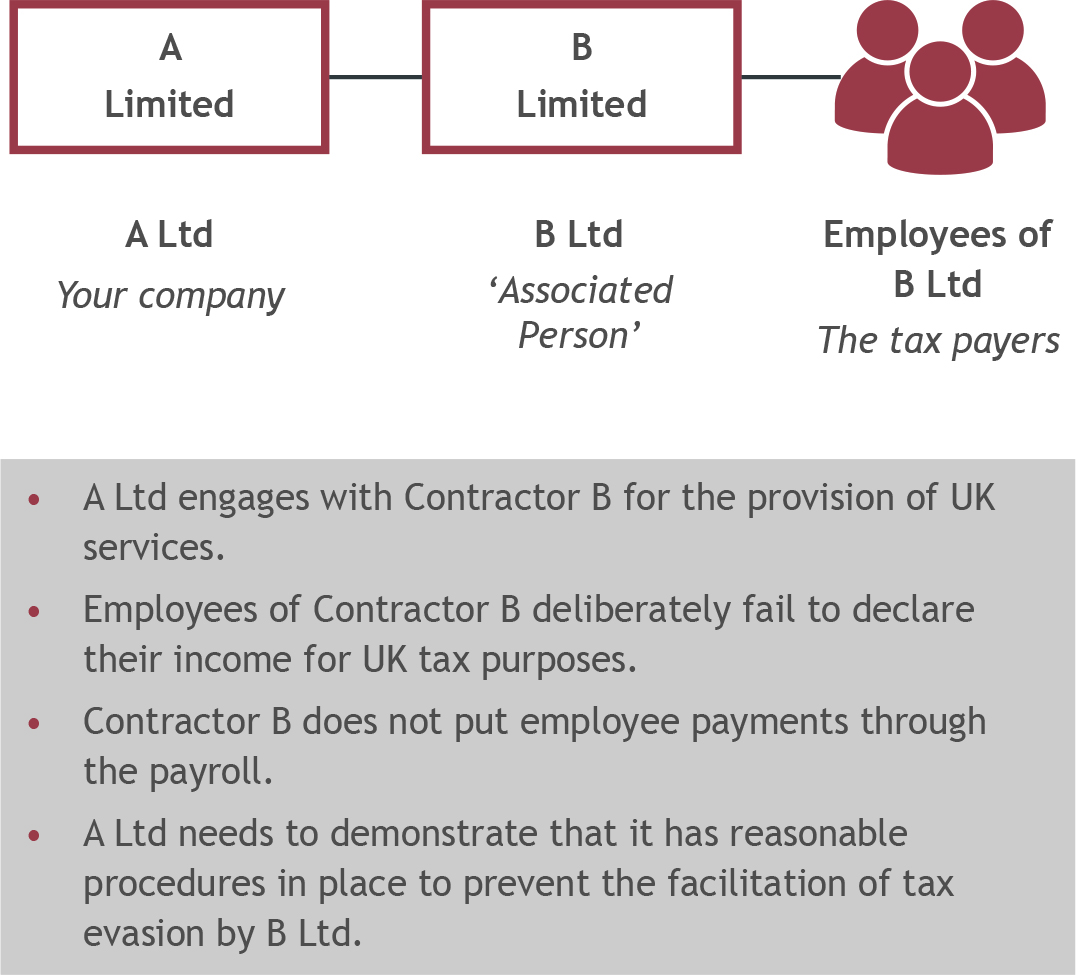

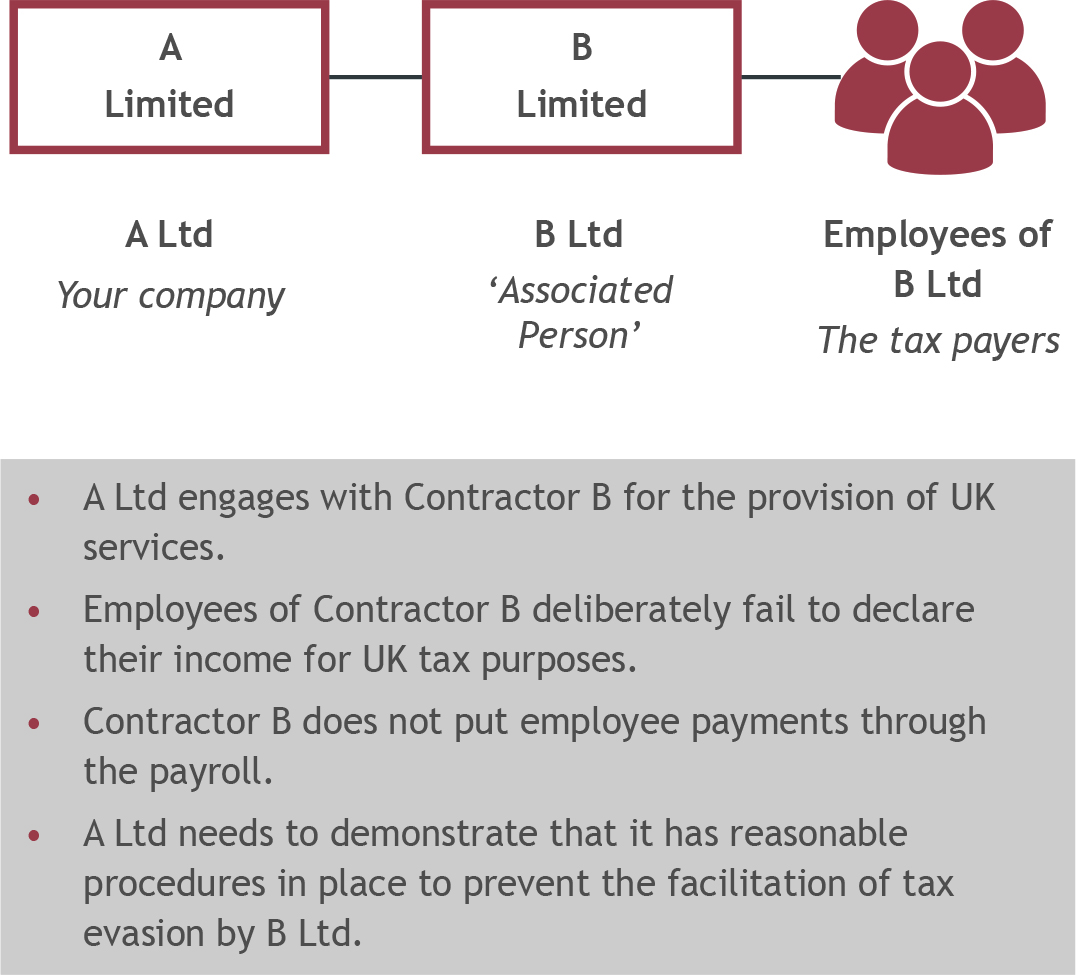

HMRC recently introduced Corporate Criminal Offence (CCO) rules which apply to all corporate entities, including partnerships and charities, who fail to prevent the facilitation of UK or foreign tax evasion by associated persons.

An associated person is defined as an individual or entity performing services for or on behalf of the entity when the facilitation takes place. This could include, amongst others, employees, subcontractors, consultants, agents and suppliers.

Three steps must exist for an offence to be prosecuted:

Stage 1 :Tax evasion offence

Criminal tax evasion by a taxpayer (either individual or entity)

Stage 2: Tax evasion facilitation

Criminal tax facilitation of this offence by “associated person” of the corporation

Stage 3: Failure to prevent facilitation

The entity failed to prevent its representative from committing the criminal act at stage 2.

Potential penalties

If prosecuted, penalties for corporate entities are severe, including but not limited to:

- Potentially unlimited fine;

- Implications for regulated entities such as losing licenses;

- Potentially prevented from bidding for public contracts;

- Reputational damage.

HMRC’s six guiding principles for compliance

HMRC have stated that it will rarely be reasonable not to have carried out a risk assessment, and their guidance includes the following six principles that businesses should use when considering compliance.

What action should businesses take?

All businesses should undertake a risk assessment to identify:

- The organisation’s associated persons,

- The opportunity, motive and means that associated persons may have to facilitate tax evasion

- Existing policies and controls that may act as part of the organisation’s prevention procedures

- Any gaps in existing procedures that need to be addressed

Following the risk assessment, businesses must implement reasonable prevention procedures and ensure appropriate documentation is retained to evidence these procedures.

How can we help?

We have supported businesses with all elements of compliance with the CCO rules, framing it around HMRC’s six guiding principles. The main areas of focus include:

Risk assessment

We have supported businesses of all sizes and across a range of sectors with their risk assessment process, from financial services to property and construction through to media and technology.

We provide context to what is likely to be considered “reasonable”, by benchmarking your procedures against those of other similar businesses.

Training

Just undertaking a risk review and implementing/ documenting procedures does not guarantee compliance; companies must also ensure that there is appropriate training in place.

We have developed a bespoke e-learning course that has been designed to address the training requirement set out by HMRC. The e-learning module takes about 15 minutes to complete and can be easily uploaded to your existing Learning Management System for roll-out to staff, or we can provide a platform through which you can distribute the training.

Ongoing monitoring and review

Businesses need to regularly review their risk assessment, particularly if the business activities change or expand significantly, for example operating in a new market or territory or working with a different type of customer.

We can undertake periodic reviews of business risk assessments to determine the reasonableness of the risk assessment and prevention procedures in place.

NTAJ1410191

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.