Farm Business Performance and why it varies

Early estimates of farm business income for 2018/19 have been published by the Farm Business Survey.

Early estimates of farm business income (a measure of profitability) for 2018/19 have been published by the Farm Business Survey (https://www.gov.uk/government/statistics/farm-business-income). The results show farm profits fell across most farm types. These are measures for the average performer of part and full-time farms collected from the Farm Business Survey. The current figures are initial forecasts, derived from information collected up to February 2019. Final calculations are due to be published later in the year.

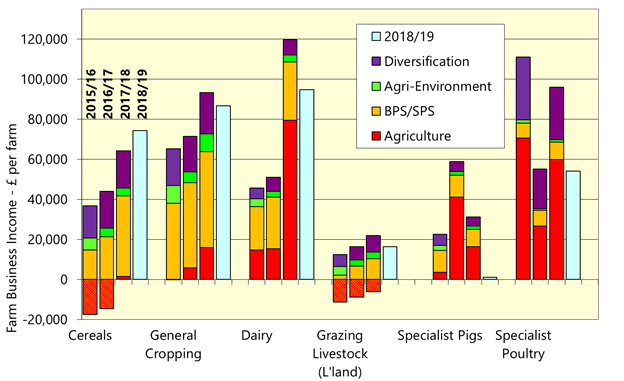

As can be seen from the chart below, profit fell for all farm types apart from cereals. While the weather during 2018 was one of the contributors to the drop, many farm types did not suffer huge yield reductions, but incurred higher costs to achieve those yields. This is especially true in the livestock sector where higher grain prices resulted in increased animal feed costs. In the pig sector, combined with lower selling prices, this has resulted in profit almost being wiped-out. Dairy and poultry farms were also hard hit by higher feed prices.

The only farm type to buck-the-trend of falling profits was the cereals sector. Physical output was slightly lower than in previous years, but this was more than compensated by higher prices (again partly because of drought conditions). General cropping farms did not fare so well as yields for crops such as potatoes, sugar beet and pulses were more adversely affected by the wet spring and summer drought.

The chart also shows a breakdown of profitability by sector. The data for the years thereafter has been split into the contribution from each of four profit centres (except for 2018/19, this breakdown is not yet available). It shows how important subsidy income (the Basic Payment Scheme and Single Payment Scheme before that, and agri-environmental income) is to the profitability of English farming. This is especially true of some sectors such as grazing livestock farming.

Being averages, the results mask a wide variation of performances, some farms making remarkable profits, others losing considerable sums. This variation also appears to be getting bigger. Evidence identifies small differences between the top and bottom performers but over hundreds of different areas. This is driven by different management techniques. The Agricultural and Horticultural Development Board has published work which statistically identified what characteristics are shared by top-performing farms and what sets them apart from their lower performing peers. This is what the best farmers do in order to outperform:

- Have a clear business strategy, shared with partners

- Set goals and budgets with timelines and values

- Compare yourself with others, not just in your sector

- Minimise overhead costs. Always.

- Know who your market is and meet their requirements

- Focus on the details but retain a view of the big picture

- Have a mindset for change and innovation

- Remain disciplined and stick to your strategy

- There are many things that farmers cannot control but what they can affect is their own business. Farmers need to continue to focus on the things they can affect.

Smith & Williamson comment: The art of farming is traditionally handed down through the generations and many farmers look to their children to take over the reins. We see the more successful farming families being those who embrace characteristic number seven above. This generally comes about with the next generation taking over control and this in itself needs careful planning and consultation with all involved. Here at Smith & Williamson we actively encourage succession planning, and work with families across the generations to help makes this transition as trouble free as possible.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.