Stocks and shares ISA vs Cash ISA - could you and should you be investing more?

Those who have managed to keep their jobs have found themselves with notably fewer outgoings over the past year – no holidays, no restaurants, no travel costs. This fortunate group has been able to save reasonable amounts of cash, of which the vast majority is currently held in cash deposits. Against this backdrop, we thought it worthwhile to discuss why cash deposits may not be as risk-free as many believe and why stock market investment may be a compelling alternative for your ISA for those able to invest in the longer term.

Those who have managed to keep their jobs have found themselves with notably fewer outgoings over the past year – no holidays, no restaurants, no travel costs. This fortunate group has been able to save reasonable amounts of cash, of which the vast majority is currently held in cash deposits. Against this backdrop, we thought it worthwhile to discuss why cash deposits may not be as risk-free as many believe and why stock market investment may be a compelling alternative for your ISA for those able to invest in the longer term.

Each individual UK resident can deposit £20,000 per tax year across a range of different ISAs – cash ISAs, stocks and shares ISAs, Innovative Finance ISAs, and Lifetime ISAs. The £20,000 can be allocated across all types of ISA, or all into one – depending on your needs. Within any ISA, all income and capital gains are tax free. It is also important to note that you can transfer between different types of ISAs without losing any of the tax breaks built up over the previous years.

A cash ISA is similar to a traditional savings account and is available to all UK residents over 16 years of age. You simply deposit your money and are paid interest. This seems like a safe way to preserve the value of your hard-earned savings. However, in an economic environment or lower interest rates and fears of rising inflation, there is no guarantee that the interest rate your ISA provider pays will be greater than the rate of inflation. In other words, your savings could be losing value in real terms. With interest rates so low, the rate on a standard cash ISA is likely to be around 0.05%, while inflation is running at around 0.7% per year1. This could rise over time: the Bank of England’s inflation target is 2.0%. Your savings will buy you less and less each year.

While we strongly believe it is prudent to hold some cash to meet short term needs, it is also important to think longer term. A stocks and shares ISA may be a better option for money that you can afford to set aside for a while. Stocks and shares ISAs have the same tax advantages as any other ISA but allow you to invest into assets such as shares, bonds, property, and commodities.

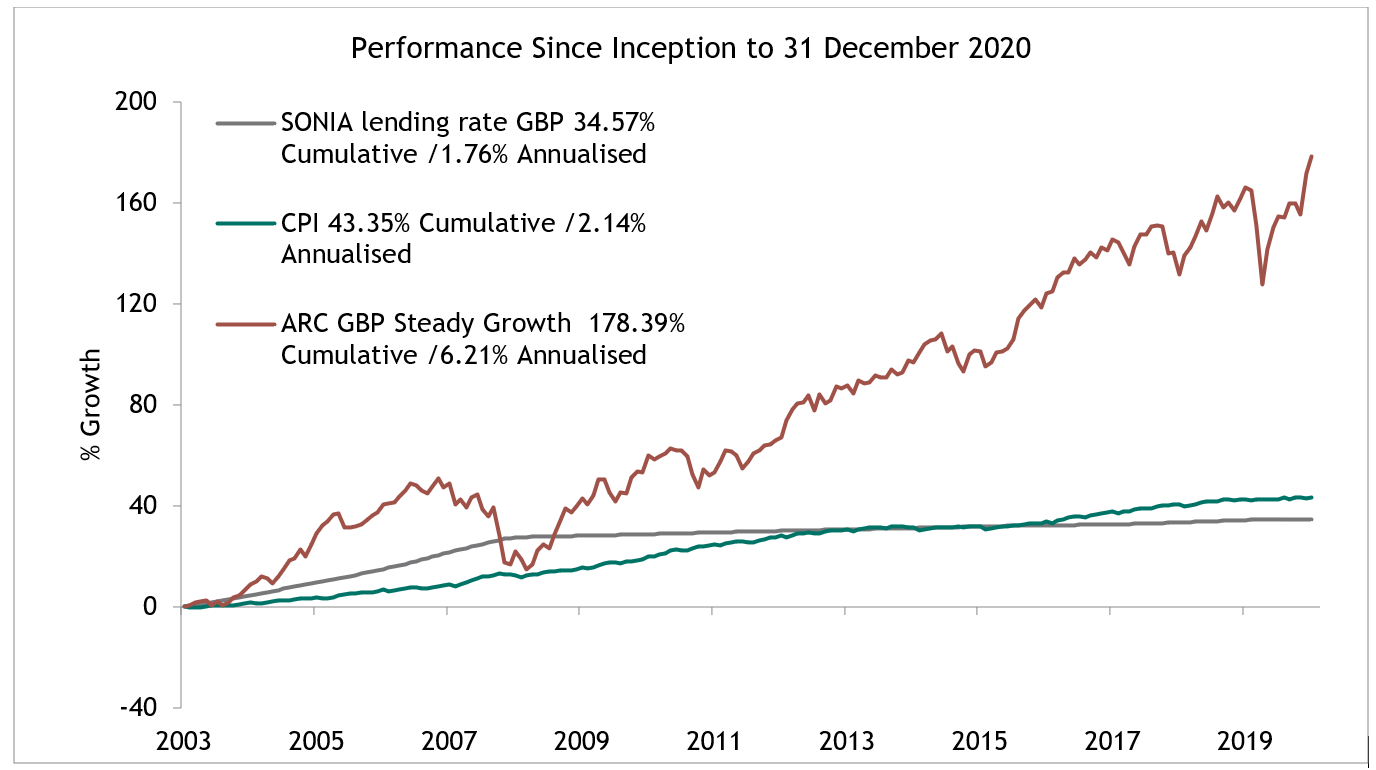

Over most long term time periods, we would expect investment in the stock market to deliver better real returns than cash and provide greater protection against inflation. While there is no guarantee of return, remaining invested over the long term, through a diversified portfolio based on your preferred level of risk, could give your investments time to benefit from the power of compounding and smooth out any volatility in the stock market. The graph below illustrates this point – since 2003, our medium risk portfolios have on average returned over 4% more on an annualised basis than the cash lending rate, which has also failed to keep up with inflation.

Past performance is not a guide to future performance.

All data is net of fees. Performance data is calculated on a UK Sterling basis. Index Data is calculated on a total return (TR) basis, i.e. including dividends reinvested, NR = Net Return i.e. total return but including dividends reinvested after the deduction of withholding tax on the dividend. Index Data and CPI data is sourced from Morningstar and Office for National Statistics. Data supplied and independently assessed quarterly by Asset Risk Consultants Limited (ARC) – this exercise is undertaken to assess risk-adjusted performance of our portfolios submitted monthly, based on the proprietary ARC indicators. Data as at 31 December 2020. For the S&W GBP Steady Growth, 433 of the Client Portfolios with monthly returns submitted to ARC were categorised in the Steady Growth category. There are 62 Data Contributors to the Steady Growth PCI. Source: Asset Risk Consultants PCI www.assetrisk.com nb* S&W ARC inception date 31/12/2003

Source: Smith & Williamson, Data provided by Asset Risk Consultants, 2021

It is also worth saying that the tax advantages are likely to be more useful when investing in the stock market through an ISA. All basic rate tax payers have a £1,000 savings allowance outside their ISA. At an interest rate of 0.05%, investors would have to have a portfolio of £2million in cash before they are generating enough income for the tax advantages of an ISA to kick in. The income on stock market investment tends to be higher, with the average dividend yield of the FTSE 100 currently 3.1%2.

If you are holding money for the longer term, it makes sense to consider investments that protect your savings from inflation and have a higher potential for growth. Savers need to be wary of excessive prudence that may damage their returns over the long-term.

If you’ve got cash that you would like to consider investing, or you are interested in starting out on your investment journey, we can help. There is often a misconception among consumers that in order to benefit from the expertise of an investment manager, you need a certain level of wealth. This is not the case, we have a variety of different investment solutions for you, understanding your needs, objectives, and risk tolerances.

Sources

1-2 Thomson Reuters

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

RISK WARNING

Capital at risk. The value of investments and the income from them may go down as well as up and investors may not get back the original amount invested. Past performance is not a guide to future performance. Further information is available in the Key Investor Information Document (KIID), the risk section of the Fund’s prospectus and the Fund Factsheet. Please read the KIID before making any investment decision.

Smith & Williamson Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Smith & Williamson Investment Management LLP is part of the Tilney Smith & Williamson group.

© Tilney Smith & Williamson Limited 2021

Ref: 54121eb

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.