US consumers are in rude wealth to spend!

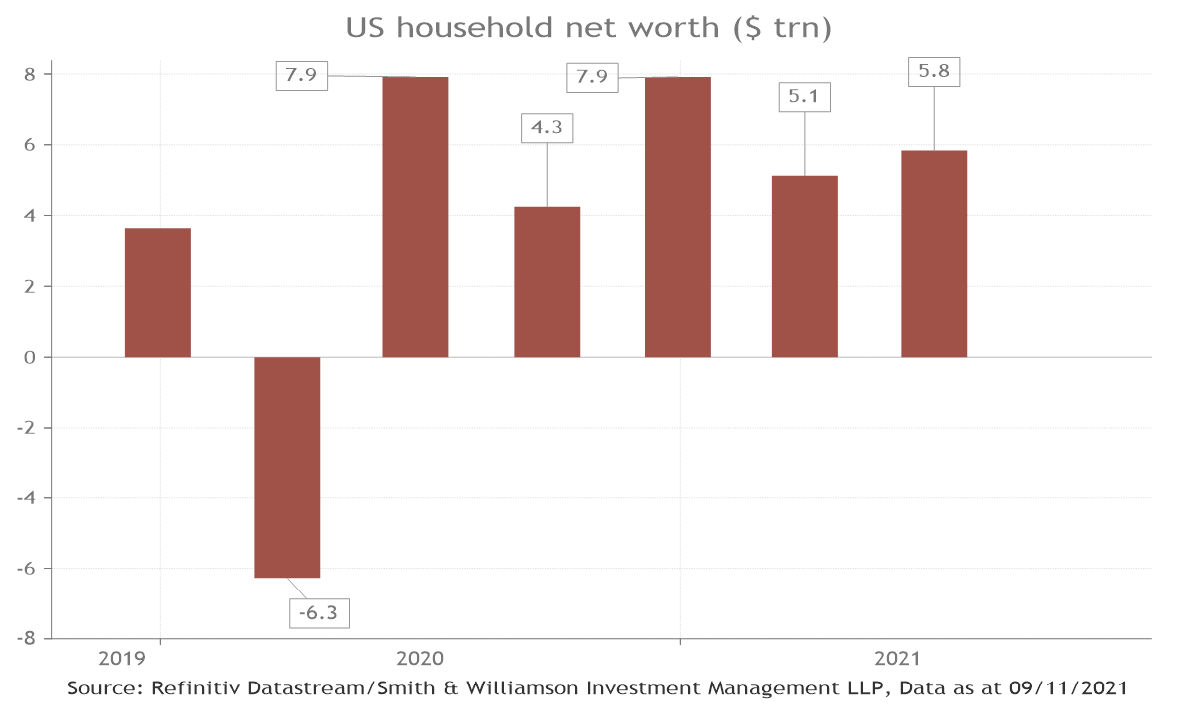

Every quarter the Federal Reserve reports on the size of US household assets and liabilities. In the second quarter of 2021, the Fed disclosed that aggregate net household wealth (assets less liabilities) rose by $5.8bn. This recent data expresses a staggering recovery of $31.5trn, following a $6.3trn loss during the start of the pandemic in the first quarter of 20201.

Every quarter the Federal Reserve reports on the size of US household assets and liabilities. In the second quarter of 2021, the Fed disclosed that aggregate net household wealth (assets less liabilities) rose by $5.8bn. This recent data expresses a staggering recovery of $31.5trn, following a $6.3trn loss during the start of the pandemic in the first quarter of 20201.

Net household worth has been driven by increased saving deposits (supported by government stimulus handouts) and rising stock markets and house prices. For instance, the Federal Housing Finance Agency house price index rose 18.5% from a year ago in August2, close to the highest rate since the series started in 1992.

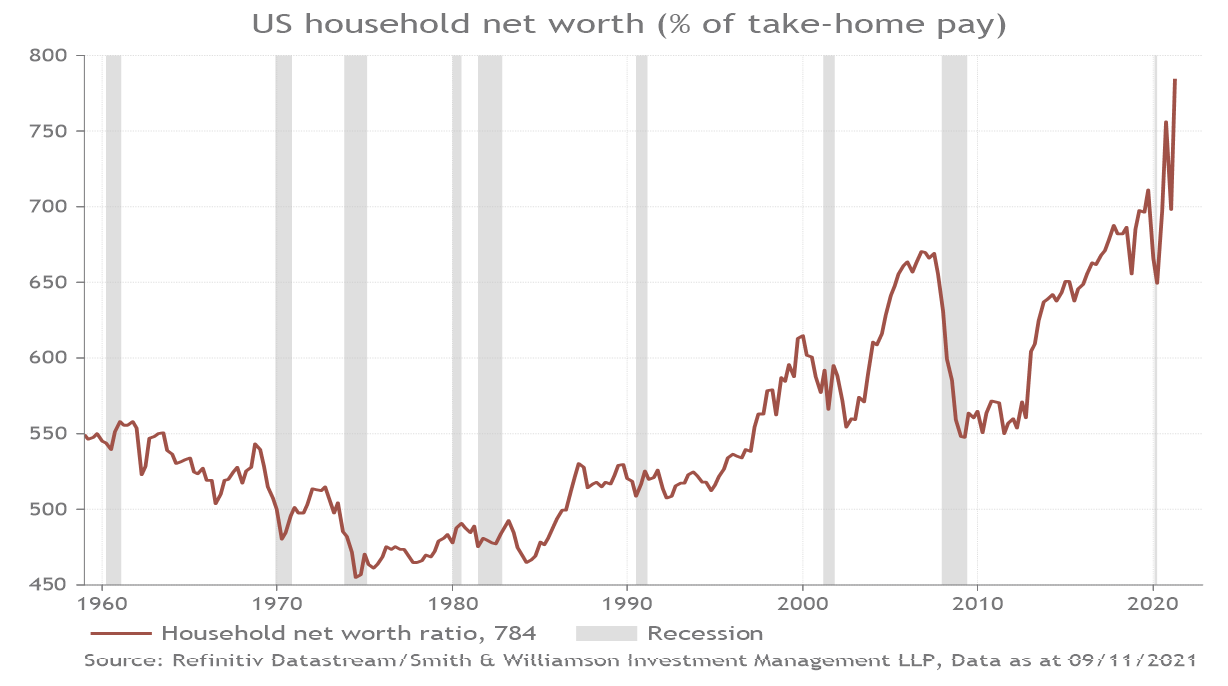

Historically, households have never been wealthier. Aggregate net household worth stands at a record 7.8 times annual take-home pay. Importantly, household assets are largely in highly liquid financial instruments, such as deposits and equities, and exceed total liabilities by 3.6 times3, the highest ratio since Elvis was rocking the charts in the late 1950s. This enables consumers to turn assets into cash quickly to spend later.

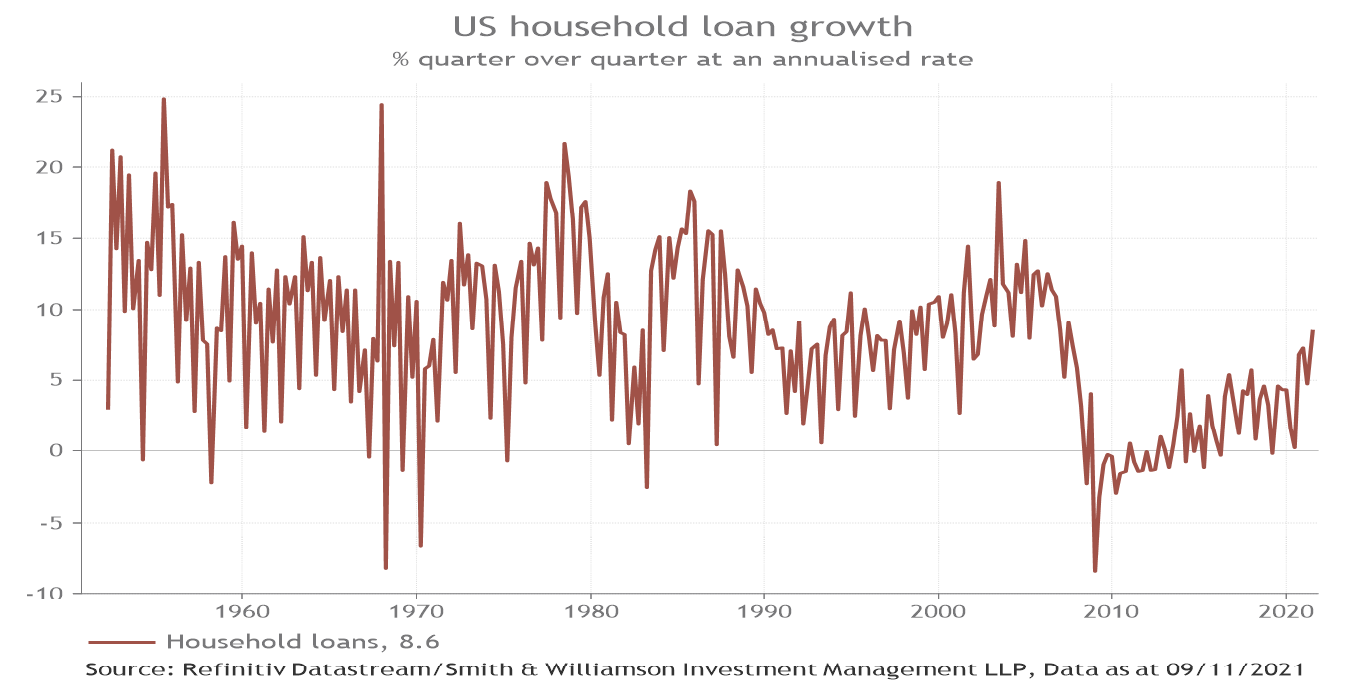

Rising net household wealth is also a powerful incentive for consumers to run down savings and borrow against assets to raise consumption. There are signs of this happening with the personal savings rate trending down and household loans (mainly mortgages) rising by 8.6% at an annualised rate in the second quarter4 - the fastest rate for fourteen years.

Aside from the sharp improvement in household wealth, personal income growth has also picked up, driven by a recovery in employment. After falling 22 million during the pandemic, total non-farm employment has since risen by 17.4 million5. Given that the economy is back to pre-virus levels and there are record job openings, there is plenty of room for job creation to continue. Moreover, employees are receiving higher wage rates and working longer hours since the pandemic broke out.

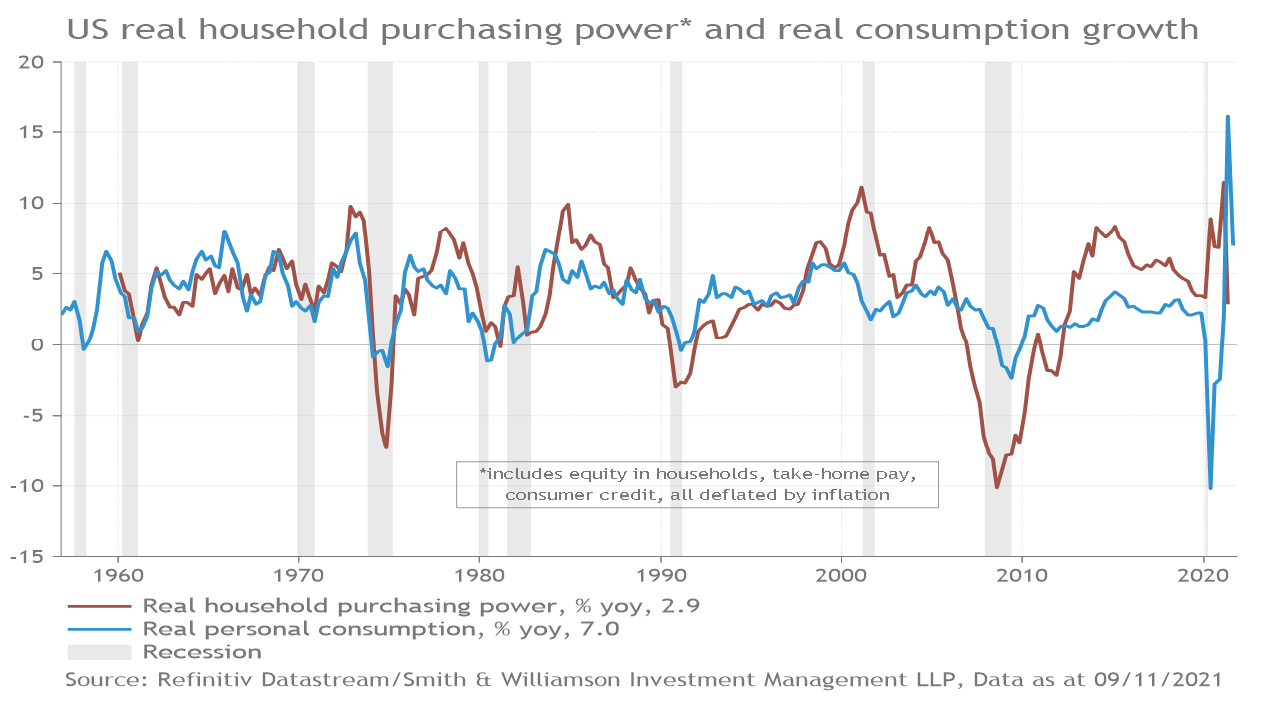

Putting together these financial resources available to consumers from housing wealth, take-home pay (income after tax is deducted) and consumer credit, this measure of US real consumer purchasing power rose 2.8% from a year ago6 in the second quarter of 2021. This should sustain real private consumption to grow at a similar rate over the next year.

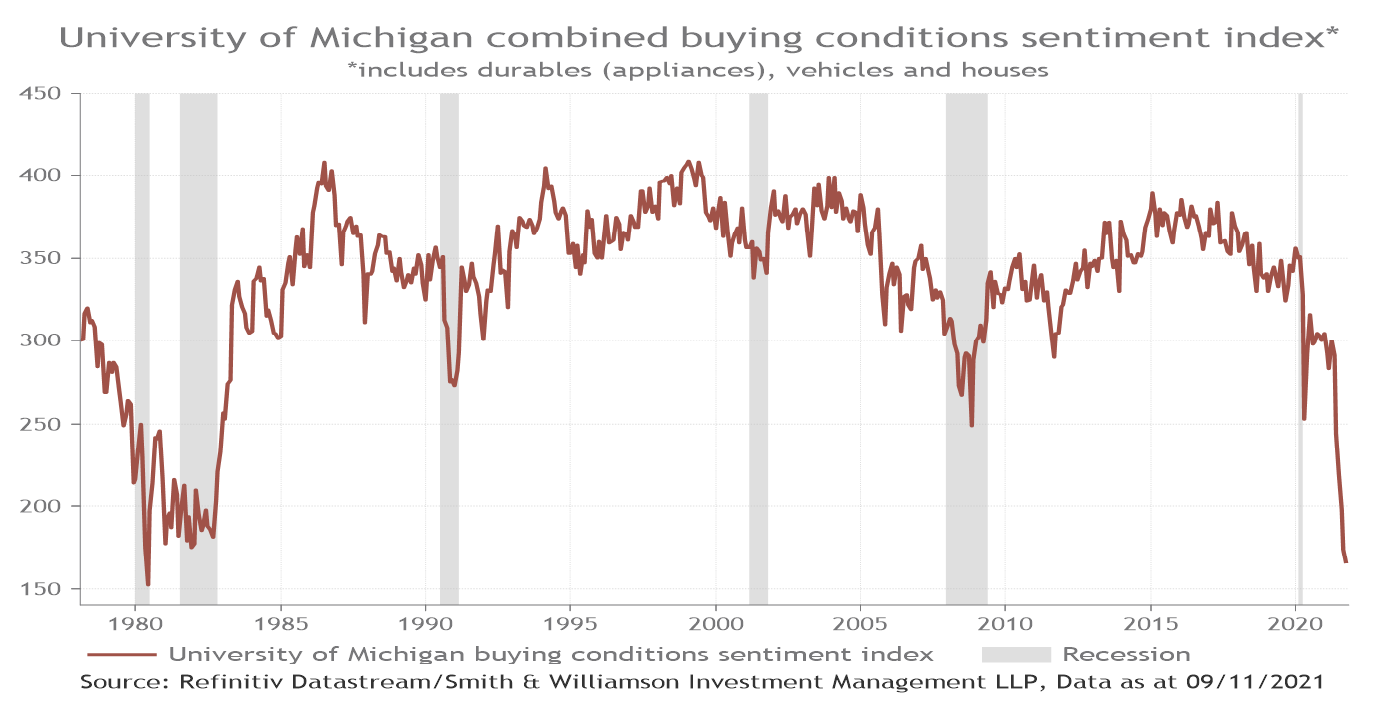

However, consumers face considerable risks that could affect expenditure growth. Firstly, the rising costs of goods and services could deter consumers from spending. Recent survey data from the University of Michigan shows that due to rising prices, consumers believe buying conditions for large appliances, such as fridges, cars and houses, have fallen to levels last seen 40 years ago.

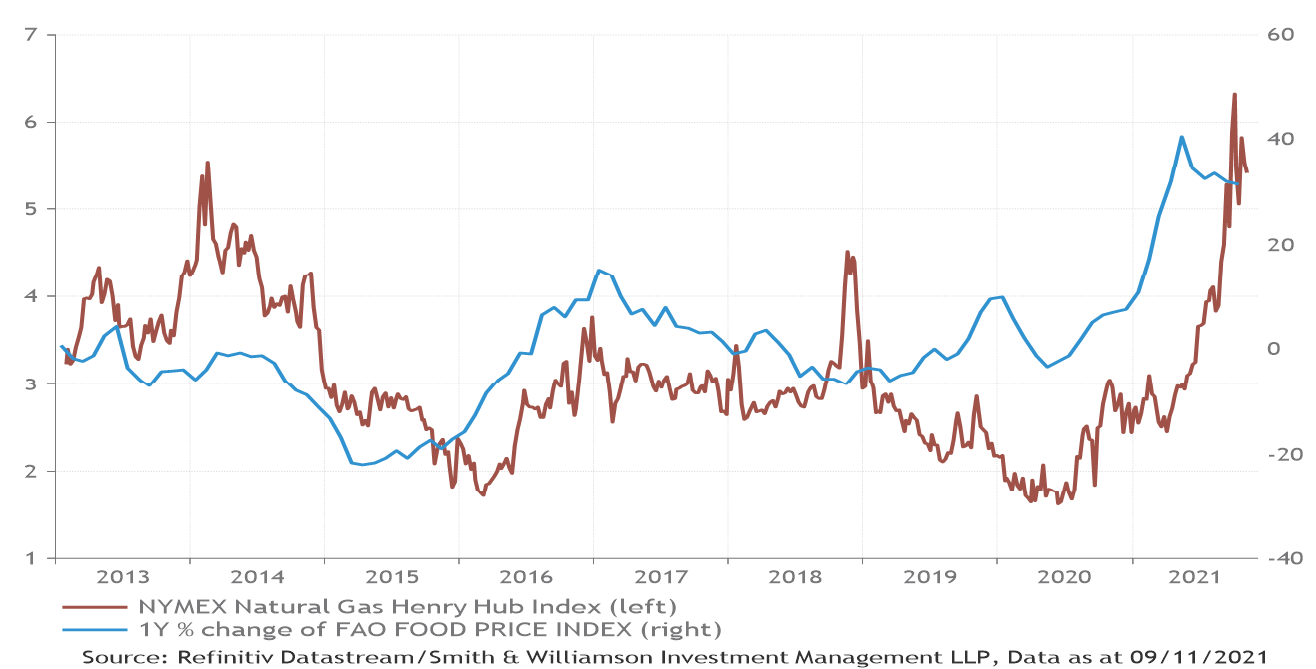

Drilling down further, rising food and energy prices are a particular concern for consumers, given they are a highly visible form of inflation. Investors tend to focus on the oil price when referring to energy prices, which has seen a sharp recovery alongside the bounce back from the COVID pandemic. The benchmark West Texas Intermediate crude oil price is up 71% year-to-date, reaching a seven-year high of $83/barrel7. This move in price is overshadowed by natural gas prices. In the US, the Henry-Hub futures benchmark is up 117% year-to-date8. The impact of this shift in price is hard to downplay given that natural gas accounts for 34% of the US’s primary energy requirements, a relatively high share compared to other major economies9.

Moving to food, supply related factors ranging from adverse weather conditions to global supply chain disruptions are just some of the reasons prices are rising. The Food & Agriculture Organisation (FAO) Global Food Price Index was up 33% in September 2021 from the same period last year10. Rising food prices experienced worldwide can be seen currently filtering through to the US.

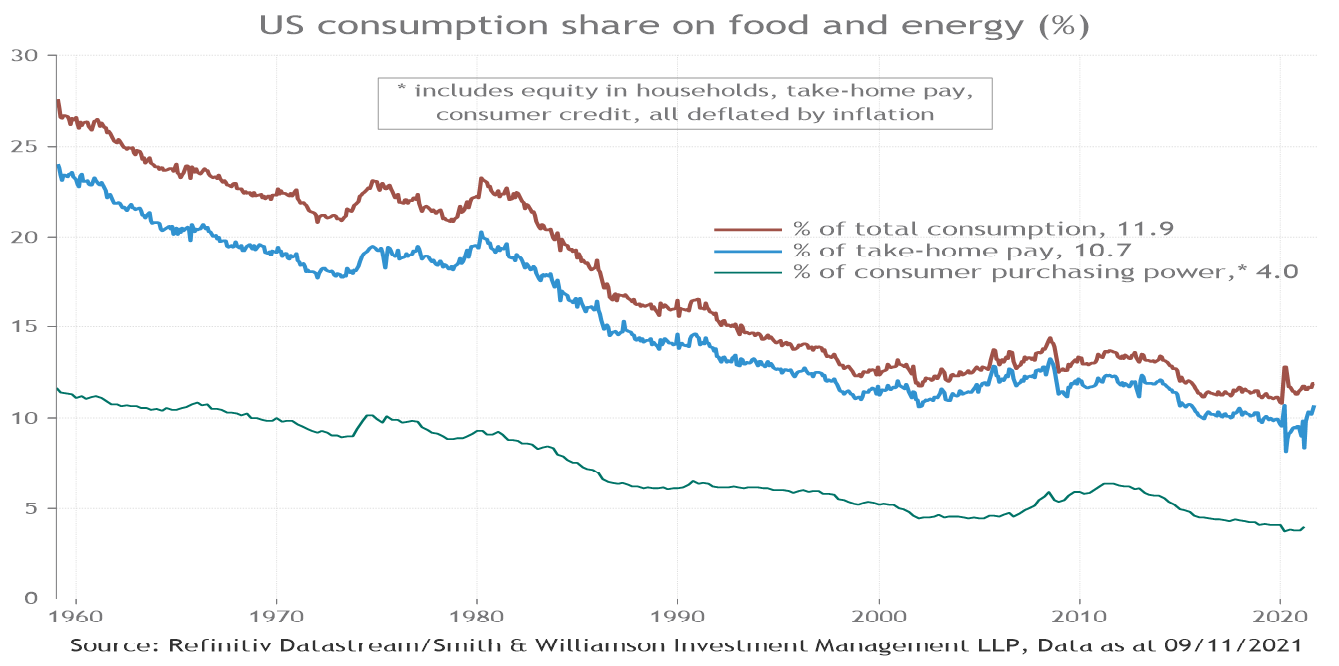

However, considering US consumer spending on food and energy as a share of total consumption and sources of income is low historically, we believe rising prices for these goods are a manageable risk for consumption growth.

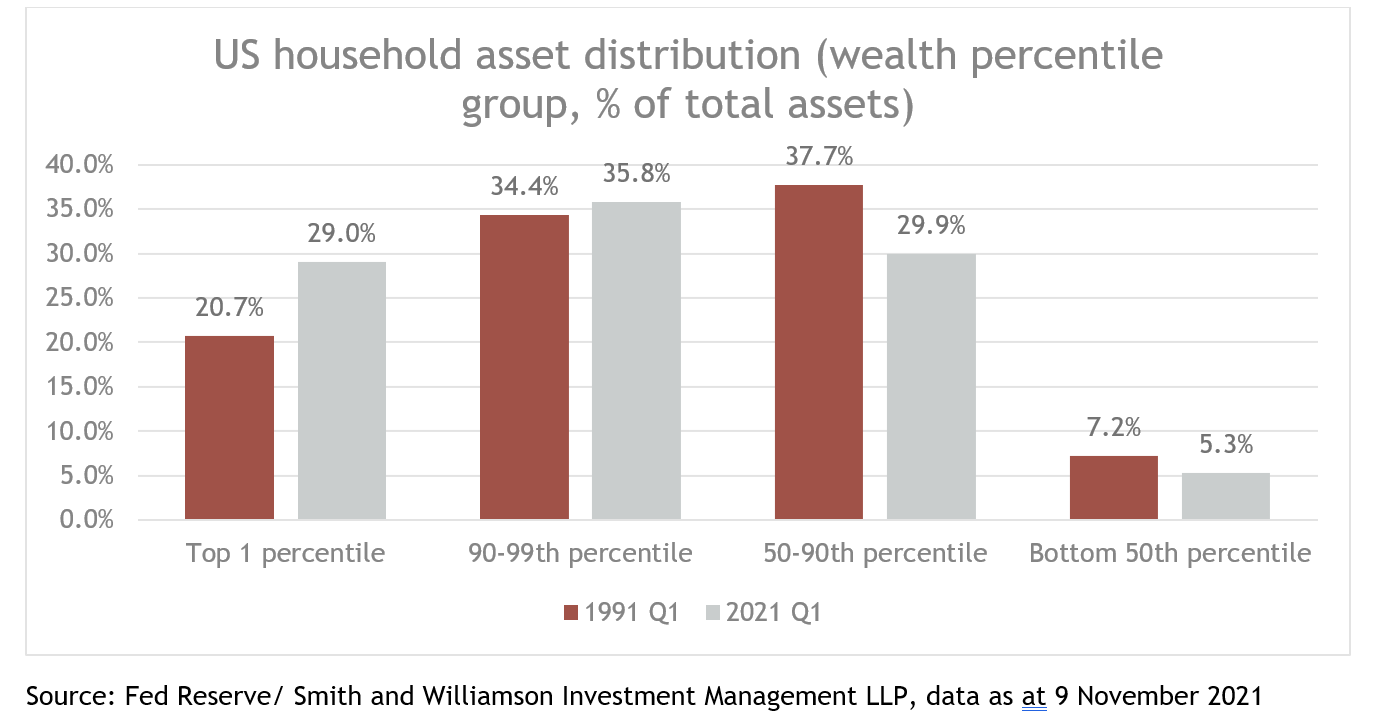

Second, rising inequality is driving a political agenda to raise taxes and redistribute wealth. Rising inequality can be traced to several factors including globalisation, the decline of unions, technological change (i.e. automation, Business Process Outsourcing) and the eroding real value of the minimum wage. Between 1991 and 2021, the top 1% saw their wealth grow from 20.7% to 29% as a percentage of total wealth. Across the same time period, the 50-90th percentile group saw their wealth as a percentage of total wealth fall from 37.7% to 29.9%11. Part of the cost of the Democrats’ social agenda reconciliation bill currently going through Congress is supposed to be shouldered by wealthier parts of society, which may have a knock-on impact to the broader consumption trend.

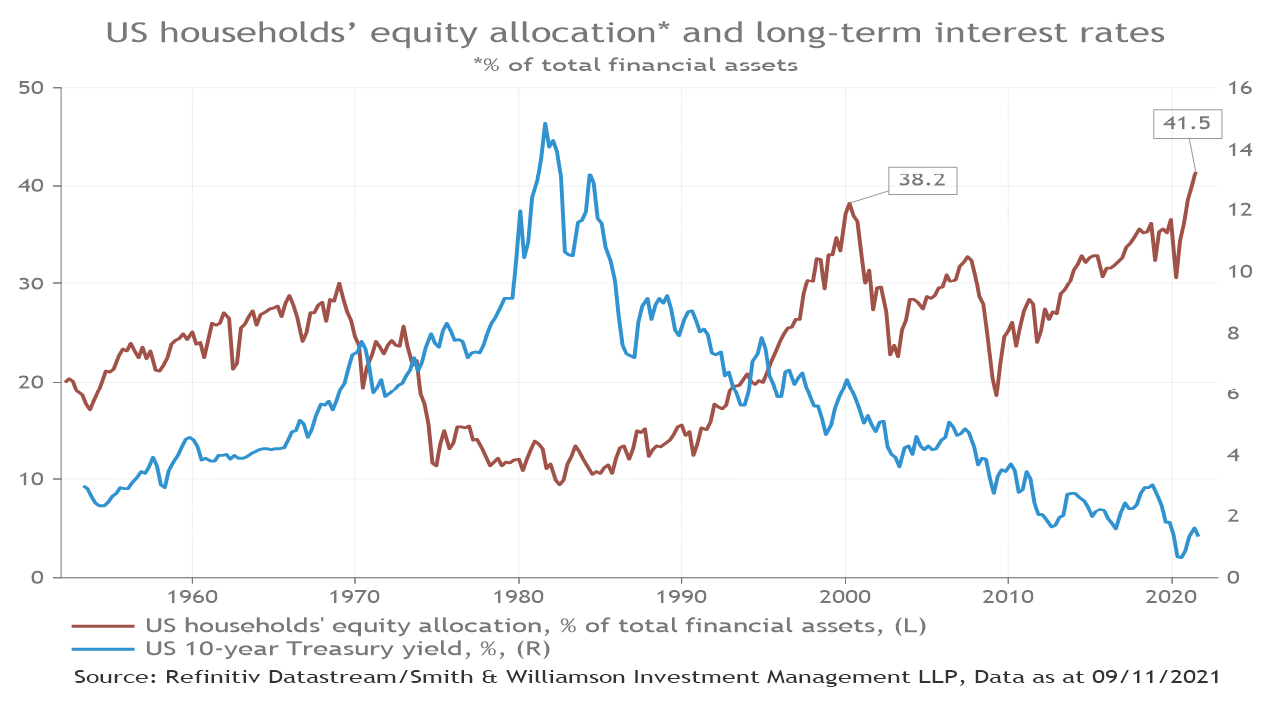

Third, should stocks correct sharply it could depress consumption, as households own a record proportion of financial assets in equities. One way this could happen is through a sharp rise in long-term interest rates. After all, lower yields from the early 1980s helped to boost the market value of equities. Should inflation result in much higher yields, stock market valuations could fall and unfavourably affect the levels of US household wealth and consumption growth.

In conclusion, US aggregate wealth is at levels never seen before. Partnered with rising personal income and improving availability to credit, this real household purchasing power supports a relatively healthy rate of consumption growth to keep the business cycle going and drive the expansion in company earnings.

Nevertheless, consumers face headwinds from rising inflation and potential tax increases that may crimp take home pay. Household wealth is also particularly susceptible to equity downside from a sharp rise in interest rates.

Despite the possible risks mentioned, we see advantageous conditions for equities. Rising wealth and income seem to have neutralised the impact of inflation and US consumers remain in rude wealth to spend.

Sources:

1, 2, 3, 4, 5, 6, 8, 10 Refinitiv, as of 9 November 2021

7, 9, Absolute Strategy Research, “Natural Gas Prices Explode" 6 September 2021

11 Federal Reserve, Compare Wealth Components across Groups, as of 9 November 2021

Ref: 136921eb

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

RISK WARNING

Investment does involve risk. The value of investments and the income from them can go down as well as up. The investor may not receive back, in total, the original amount invested. Past performance is not a guide to future performance. Rates of tax are those prevailing at the time and are subject to change without notice. Clients should always seek appropriate advice from their financial adviser before committing funds for investment. When investments are made in overseas securities, movements in exchange rates may have an effect on the value of that investment. The effect may be favourable or unfavourable.

Smith & Williamson Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Smith & Williamson Investment Management LLP is part of the Tilney Smith & Williamson group.

© Tilney Smith & Williamson Limited 2021

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.