What lies beneath?

Our experts analyse the finances of the top 50 UK law firms and discover that all may not be as good as it seems.

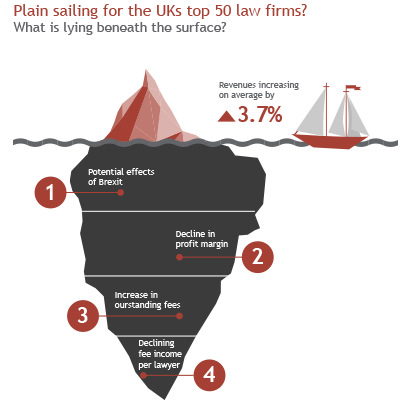

On the face of it, 2015/16 results for the UK's top 50 law firms show a positive headline, with revenues increasing on average 3.7% (prior year increase of 1.8%).

However, removing the impact of mergers, team hires and fee inflation, underlying organic growth in legal work is unlikely to have accounted for much, which is perhaps surprising given the relatively stable pre-referendum economic environment. With more uncertainty ahead, law firms need to look beneath the headline figures and ensure they have a strong base to enable them to deal with the challenges facing them.

Giles Murphy warns against focusing only on the headline revenue growth figures and ignoring other crucial statistics which could be indicating troubles beneath the surface. (Video reproduced with kind permission from Legal Week)

Squeeze on profits

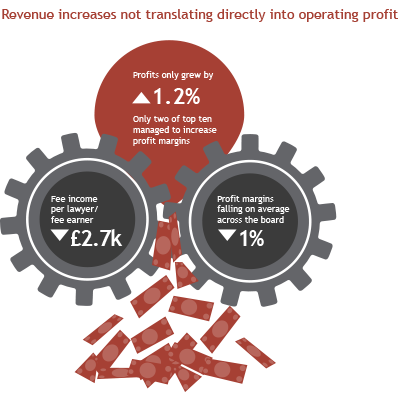

Compounding the issues above, revenue increases have not translated directly into operating profits, which only grew by 1.2% in the year. Only two of the top ten managed to increase their own profit margins, with margins falling on average from 32% to 31% across the board.

This demonstrates that the marginal cost of performing additional work is greater than the historic costs the firms have faced in delivering their services. Clearly this is a trend that cannot continue, and each firm should assess the underlying reasons why.

In recent years, to capture wider market share, law firms have been broadening their sector and service specialisms, with firms successfully achieving team and lateral hires. However, increasingly clients have become far more knowledgeable about what they specifically require, the services they need and the price they are willing to pay. They are increasingly more discerning and will proactively search out a better deal. Lawyers need to demonstrate what value they add whether through specialist advice, experience of similar issues, enhanced customer service or access to new insights.

Productivity wanes

Fee income per lawyer has also decreased over the past two years from £307,600 in 2013/14 to £304,900 in 2015/16, providing further evidence of declining productivity. This is perhaps surprising given the continual investment in technology and more cost effective ways of delivering services that firms have been exploring. Ultimately it might well reflect the challenges firms face in winning new work in a highly competitive market.

While we are seeing signs of change, the legal profession has historically been slow to adopt new technology and arguably this necessary investment in improving efficiency is not being delivered fast enough to deal with competitive pressures.

One example of this is the adoption of early stage AI software but this is for the most forward looking and by no means are we seeing mass take up. Adopting new technology does not necessarily have to change the culture and nature of what a firm does, but for example, investing in work flow systems to reduce manual processes such as systems to automate the collection of overdue fees could have a huge impact on cash flow.

Vital to increase flow of capital

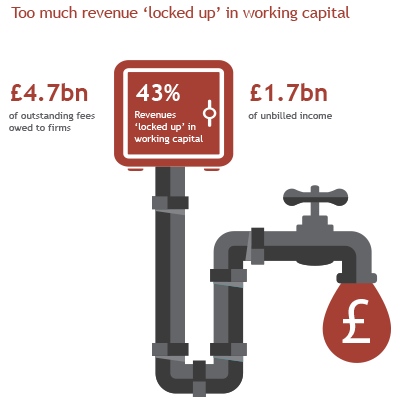

In 2015/16 almost 43% of revenues were ‘locked up’ in working capital.

With over £4.7bn (2014/15 £4.4bn) of outstanding fees due to firms and £1.7bn (2014/15 £1.6bn) of unbilled accrued income, the top 50 firms saw an increase in each in excess of 7% over the year.

Clients took, on average 119.3 days to pay their lawyers, which is way beyond the standard credit terms of all firms in the top 50. This has increased from 118 days in 2014/15 and from 116.2 days in 2013/14.

A shortening of debtor days to around 100 (which would most likely still be well outside a firm’s normal credit terms) would equate to an extra £700m of cash across the top 50 firms’ balance sheets to fund investment, create more financial stability and potentially allow for the earlier paying out of partner distributions.

Many firms are still relying upon historic billing practices and are failing to adopt new practices where cash inflows from client work more closely match their own cash outflows. However, with our top 50 now experiencing further cash flow pressures perhaps it is now time to look at billing on an earlier and more regular basis.

Taking the administration of billing away from those actually doing the fee earning work could also lead to improvements. In doing so, the billing cycle will become more efficient and frequent, while fee earners focus on client relationships and work without having to worry about cash flow.

Looking ahead

This erosion of productivity, operating margins and an increase in lock up should be ringing alarm bells for some firms. With one high profile firm going into administration in January 2017, decision makers at all of the top 50 would be well served by checking to make sure the headline revenue growth figure is not masking further problems.

Given that the top 50 firms require around £500m a month in cash just to satisfy employee salaries (not including partner drawings), if the worsening lock up trend continues it might not take long for some to suffer from cash flow shortages.

The issues of the relationship between the EU and the UK, greater pressure on the legal market from new entrants and the pace of change within the legal sector itself all add to the challenges that are being faced. As we enter what are likely to be more uncertain and volatile times, firms should be building up their cash balances to help them weather any storms ahead.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Disclaimer

This article was previously published on Smith & Williamson prior to the launch of Evelyn Partners.